As published in BusinessAir Magazine issue #9 2021.

As published in BusinessAir Magazine issue #9 2021.

Last month we discussed what is going on with used aircraft values. In this article we will provide some background for consideration.

The used aircraft market represents the closest market to Adam Smith’s invisible hand. While it is small and subject to various whims of irrational buyers, it is still a market that no one really controls. In other words, with so many individual buyers and sellers, one or two sellers really do not have any measurable control over prices.

The real drivers in market pricing are based on supply and demand and are in harmony with economic theory.

The question many are postulating is, are the current prices over market. They certainly appear that way based on where prices have been, however are they really?

We did a brief market analysis of a few popular and a couple of less popular makes and models to determine if the current level of pricing is really above historic real depreciation curves. What we found is that many of the popular selling aircraft are still below the historic depreciation curves. The less popular planes are still below where their historic curves have been.

What this means is that many models still have upward price capability before they are over the historic norms.

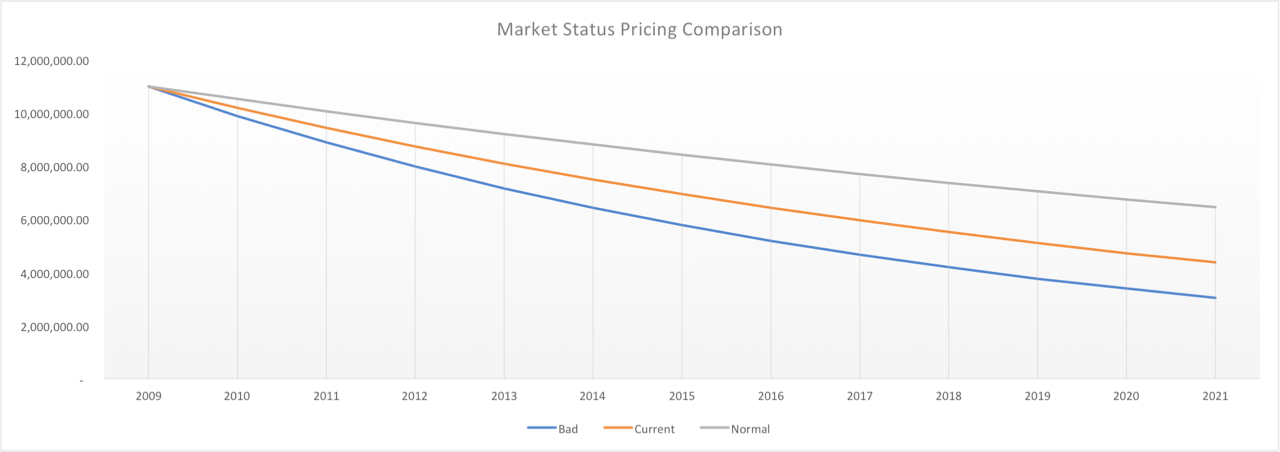

We approached this two different ways. Thanks to Dennis Rousseau and Aircraft Post we were able to look at average prices in various years. First we took the average selling prices based on several popular models in 2019. We then used exponential decay based on historic market depreciation to determine what these aircraft would be selling for today if the market was “normal”.

The results showed that in many cases the prices were not over inflated and there was still margin for prices to move up before they became priced over historic norms. The C-300 was one exception and it is at par based on the current market. The C605 and Falcon 2000EX still have upward price capability before becoming par.

We then ran a historic exponential curve on various 2008 model aircraft based on their new prices and determined where aircraft prices would be historically if the crash and stagnation in our market had not happened. The results were nearly identical to the 2019 data. The second method also showed there is still upward room for prices before they become higher than the historic curve.

Historic norms that are viewed over long periods of time versus a snap shot in time provide a better 41,000 foot view. We have seen this over time with excess depreciation and bubbles where planes sold for more than they did new. Only taking one period of time versus taking a long view can lead to a misleading analysis.

While as a buyer you might not get as good a deal as you could have previously, the fear of overpaying should be looked at within the context of history. We cannot erase history and the market had much higher depreciation rates post 2008, however thinking that that is the new normal is not correct. This time period took much longer to get back to normal but it appears that the market is adjusting back to historic norms. This is a good thing for our industry.